For digital receipts, make the most of cloud storage or accounting software with safe backup choices, guaranteeing your data is protected and accessible anyplace. In today’s digital age, leveraging know-how can considerably simplify receipt administration. Use mobile apps and scanners to digitize paper receipts, making certain they’re stored safely and are easily accessible. Digital formats are additionally easier to arrange, search by way of, and share along with your tax preparer. For self-employed individuals, saving receipts is even more necessary. You can deduct varied business-related expenses, together with supplies, supplies, office gear, and travel.

Faqs On Organizing Receipts Electronically

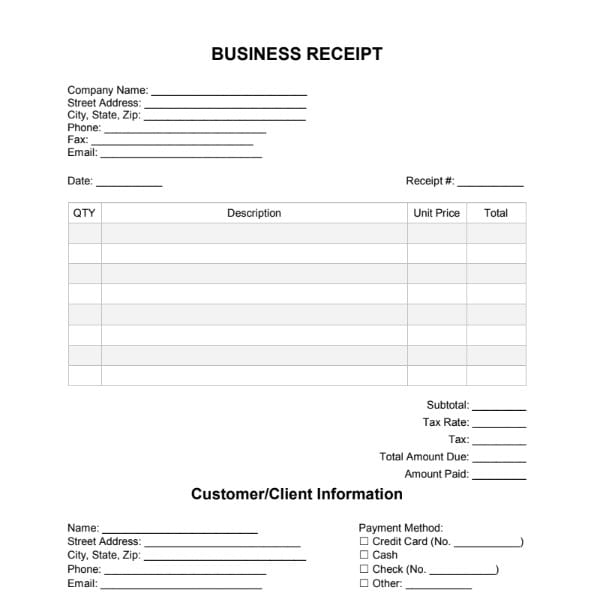

Take a picture of your receipt utilizing your mobile gadget’s digital camera https://www.kelleysbookkeeping.com/ and the Shoeboxed cell app. The app routinely uploads the data into your Shoeboxed account. Back up digital receipts often to the cloud or an external thumb drive. Here, we’ll present you the best technique for saving receipts so you’ll be able to stay on high of your finances and your business, and feel more comfortable. Right Here are the 6 best ways for you to organize your receipts electronically.

How To Arrange Receipts For Taxes And Stay Irs Audit-proof

With a strong recreation plan and a dash of consistency, you’ll turn right into a receipt-organizing superhero very quickly. You can reach your receipts from any system with internet. We’ll speak about this within the subsequent elements of the article. This article will delve into the most effective best way to save receipts for taxes methods to retailer receipts, offering ideas and strategies that can help you keep organized.

How Can A Business Owner Combine Shoeboxed Into Receipt Management?

However, it’s essential to keep and arrange all receipts. For those who don’t wish to scan themselves or have a big quantity of receipts, Shoeboxed has the Magic Envelope service. Use your smartphone’s digicam to take an image of the receipt, and the app will addContent the data to your Shoeboxed account. Digitizing and storing receipts with Shoeboxed is straightforward and fast. Sure, the IRS accepts digital receipts as long as they’re clear and accessible. Create clear insurance policies for expense reports and worker reimbursement to be clear.

- For those that don’t need to scan themselves or have a large volume of receipts, Shoeboxed has the Magic Envelope service.

- Getting organized for tax time will make your life simpler.

- Storing receipts could be a breeze with a bit of planning.

- For companies and employees, receipts are required for expense reimbursement.

- As A Substitute of letting bodily receipts pile up in a shoebox, one of the best and most efficient method to manage your receipts and hold them safe is to do so electronically.

Medical Expenses

Properly organizing, categorizing, and retaining these receipts is important for maintaining financial accuracy and compliance with tax rules. You usually are not required to maintain paper receipts for tax functions if you can produce accurate and readable digital copies. The IRS accepts digital codecs as lengthy as they’re a real and accurate representation of the paper originals and are readily accessible if needed. This clarity helps maximize your eligible deductions while minimizing the chance of an audit. If the IRS does audit your small business, having separate accounts offers clear proof that supports the legitimacy of your corporation bills.

Shoeboxed mechanically organizes this information, permitting you to categorize your expenses effectively. You can also create custom classes to match your specific tax submitting needs. This habit prevents the last-minute rush and reduces the chance of losing receipts.